Suncorp Bank enters buy now pay later market with Visa Australian FinTech

Suncorp to launch buy now pay later services from November

Suncorp Bank is excited to announce PayLater, our new interest-free Buy Now Pay Later offering which can be used to make payments at more than 70 million… | 16 comments on LinkedIn

Suncorp Bank joins buy now, pay later trend

Suncorp Bank PayLater is a 'buy now pay later' product that lets you pay for purchases interest-free over four equal payments. Commonly asked questions How can I apply for Suncorp Bank PayLater? Can I request an increase to my Suncorp Bank PayLater spend limit? Can I make Suncorp Bank PayLater payments early?

Suncorp Bank Howto Guide you Customer ID YouTube

After applying successfully for a Suncorp Bank PayLater account, you can access a $1000 spend limit, letting you pay for purchases interest-free and over four equal, automatic payments.1 You can make payments manually in the Suncorp App at any time. You can even adjust your payment day by up to six days. Worldwide Visa Debit convenience

Infographic Credit card killer? The rise of BNPL Tartufocracia

7:06PM September 6, 2021. Comments. Suncorp's banking arm has moved to stake a claim in the buy now, pay later (BNPL) land rush, partnering with Visa to offer an interest-free platform that can.

Suncorp takes on Afterpay with buy now pay later card

Australia's Suncorp Bank has joined the increasingly crowded Australian buy now pay later (BNPL) market after it announced on Monday (6 September) that it will start offering such services later this year. The bank's new PayLater service will be launched in partnership with Visa in November.

buy now pay later Buy Now Pay Later or credit card? You choose EconomicTimes

Suncorp Bank is the latest bank to board the buy now, pay later train, partnering with Visa to launch PayLater. By Alex Brewster. on 06 Sep 2021. Available to Suncorp customers from November, the offering can be used wherever Visa is accepted, at more than 70 million merchant locations worldwide. Customers can split purchases over $50 into four.

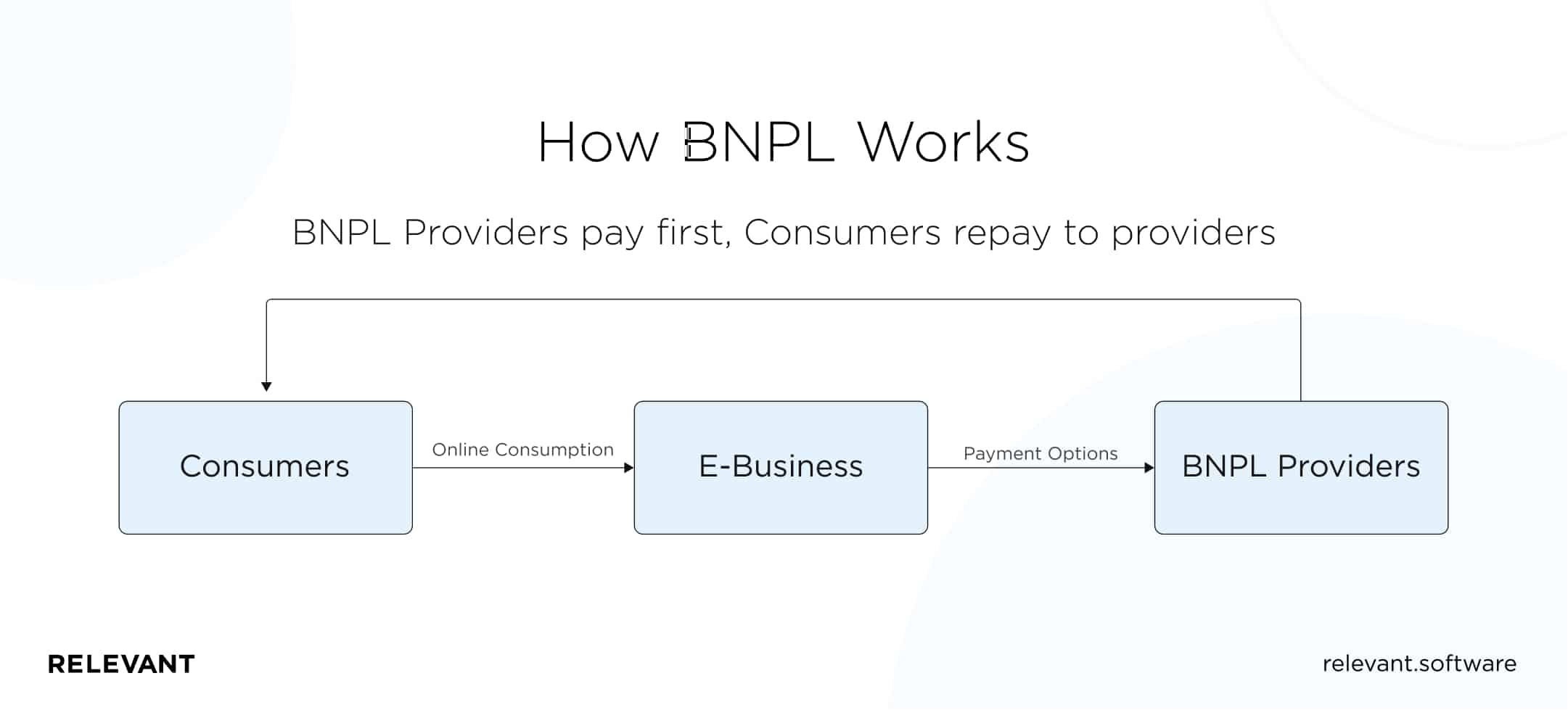

Buy Now Pay Later App Development in 2022 Quick Guide

Buy now, pay later Suncorp Bank PayLater repayments, refunds & more. Accounts Getting started, managing your account, flexiRates, Term Deposits & more. International Paying and receiving funds from overseas. Security Keeping yourself safe, Suncorp secured app & more. Carbon Neutral Certification

Buy Now, Pay Later Jamaican Cravings Box

PayLater will be available for purchases higher than $50, up to a limit of $1,000 once Suncorp determines a customer's eligibility following a credit check. Suncorp says eligible customers will receive "quick approval" after applying online or via the Suncorp App. Repayments will then be made in four equal fortnightly instalments.

Suncorp launches buy now, pay later service

Suncorp Bank is introducing a new interest-free buy now pay later (BNPL) offering which can be used to make payments at more than 70 million merchant locations worldwide, wherever Visa is accepted. In a first for the Australian market, Suncorp's PayLater will include both a physical and digital Visa debit card to shop in-store and online.

Buy Now Pay Later Solutions BNPL UK

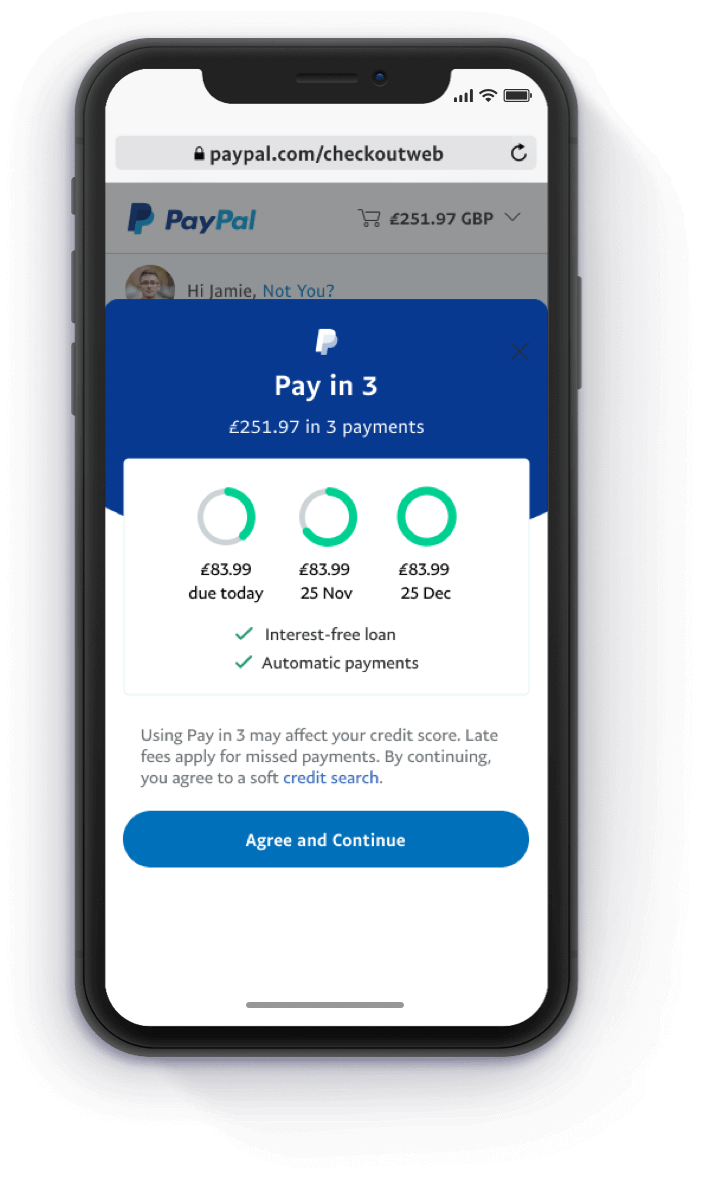

The use of buy now, pay later plans skyrocketed during the 2023 holiday season. According to Adobe , which tracks online sales, buy now, pay later plans use was up 47% on Black Friday and 43% on.

Buy Now, Pay Later Offer Instalment Payments PayPal UK

Suncorp has joined the growing buy now, pay later trend (BNPL), teaming up with Visa to launch the interest-free offering, PayLater. BNPL has become one of the most competitive financial products to enter the Australian market in years, with more than half a dozen options available. AfterPay is the dominant player in the increasingly crowded.

SUNCORP Adult Now Pay Later Brightworks

Suncorp Bank has today launched PayLater, its interest-free buy now pay later (BNPL) offering, which is available to use at more than 70 million merchant locations worldwide, wherever Visa is accepted*.

Suncorp announces PayLater, a Buy Now Pay Later debit card

The bank unveiled the new product in September 2021 and has billed it as a 'pay later debit card', which has been reported to be more like a credit card that charges no interest or ongoing fees. The service called 'PayLate' is available at around 70 million locations globally, or wherever Visa is accepted, and the service would be.

The Fragrance Shop Buy Now, Pay Later Milled

Suncorp Bank has partnered with Visa to launch a new buy now, pay later (BNPL) service that will cap late payment fees and allow customers to shop in stores.

24 Buy Now, Pay Later Statistics for 2023

September 6, 2021 19 Views Suncorp, the Australian insurance, banking, and finance firm has announced that it will launch its own buy-now-pay-later service PayLater. With this, Suncorp aims to add more payment options for its customers.

.png#keepProtocol)

What is Buy Now Pay Later ( BNPL )? Comprehensive Guide

Suncorp will join the stampede into the buy now, pay later sector. Attila Csaszar Mr van Horen, the chief executive of Suncorp Bank, said the lender believed there would remain strong demand for credit cards, but at the same time many younger people were opting for BNPL products.